Happy Canada Day! I'm enjoying my day off by doing laundry and cleaning my floors. Then maybe venture outside and see how many weeds I need to pull out of my garden, that's just a maybe though ;)

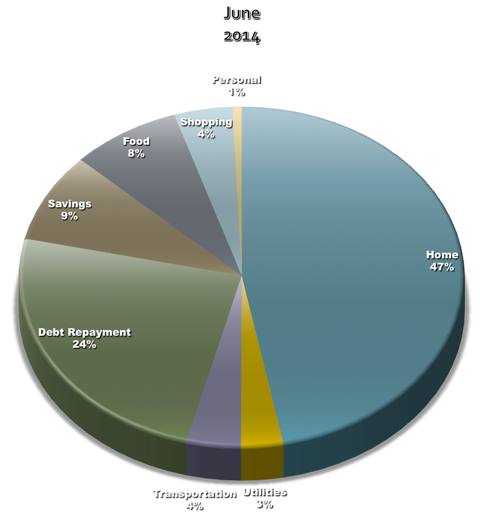

Debt Repayment: (24%)

I hope this is the last time I ever have to talk about this category again! G & I kicked our Line of Credits ass this month. I explained our payment breakdown in detail in my last post so I won't explain it here. It's done!! :D

Savings: (9%)

Our savings this month was a lot lower then we normally try to save, and it should be even lower since we completely drained our emergency fund, but I'm not sure how to show that in my budget since everything goes thru our chequing account. Oh well, next month this number is going to be a lot higher as we focus on replenishing our EF.

Food: (8%)

We spent A LOT on food this month. Over $1000.00 for just two people... that is embarrassing to write. BBQ meat is the killer of our budget though and we entertained a few times this month for some of G's co-workers (and those drop in's are usually unexpected and G ends up going to the store to get some BBQ stuff because it's the easiest). Ugh and my plan of eating what we had fell to the waist side but I still have the sheet of meal plans so I hope to draw from that a lot in July.

Shopping: (4%)

Mostly home stuff; like a new wireless router, some tools G wanted that were on sale, some nail polish for myself (not home stuff lol).

Personal: (1%)

Only thing that was personal this month was my father's day gift! At only 1% it looks like I actually didn't get him much but my mom says he wears the safari sun hat I got him nearly everyday :) It'll be perfect for him to use during their summer vacation as well since they both do a lot of hiking.

Home: (47%)

That GIANT pie slice is what a new roof looks like ladies and gentlemen. Another major factor in clearing out our emergency fund but it was completely paid for in cash (well, cheque actually) and it could not have been completed at a better time as we've had a ton of rain here this month! Oh the joys and responsibilities of home ownership :P

Utilities: (3%)

Normal, aka boring

Transportation: (4%)

I transfered to an office here in town at the end of last month so I'm not commuting 1 hour a day round trip, 5 days a week to get to work. It takes me 5 mins to walk to work or under a minute in the car for the days we had some really bad weather. We only filled up the car once this month, rather then once a week. This number is just car payments, insurance and the bit of gas.

---------------------------------------------------------------------------

This month started off really down for me but ended on the huge high note of finally paying off our LOC. I'm not going to lie: I'm actually kind of nervous about slipping into old habits when it comes to our spending because we don't have our debt payment being our main focus. Since we've both turned 18 and had credit cards, G & I always had consumer debt. Getting into that shift of re-adjusting to savings is somewhat terrifying. We've both talked about this a lot on weekend and we opened 2 savings accounts: one for my personal spending and one for G's personal spending. Each paycheque he gets we set it up so $100 automatically gets send to his account and same with my paycheques, $100 into my account. G & I both realized we need limits when it comes to our spending and this way we each have our own spending accounts. We also promised not to judge each other's purchases either, that way I don't have to complain about how expensive video games are and I don't have to hear him nag about how much stuff at Sephora is. :) I think this is going to be excellent not only for our budget but for our marriage as well! :P

- M

PS: I don't want to get all sappy but I really want to say thank you for everyone who has their own personal finance blog. I honestly do not think I would be in the position I am today with my finances if it was not for reading other peoples post. They are constant inspiration and always motivate me. I'm really glad I found this community when I did :) Thank you!

We all get our motivation from somewhere, and like you, a lot of mine came from reading PF blogs. I fully credit those blogs and Gail Vaz Oxlade for all the wonderful changes and awarenesses in my money mentality. So glad there are folks out there who inspired you.

ReplyDelete